I am incredibly fortunate to have such a large amount of money available in such a short period of time to invest in fantastic businesses.

It really is because I stopped making excuses about money in December of 2014. I work all week, and use what time I can find working my side-hustles. It isn’t easy, I have a wife and two kids under two years old. I earn $65k a year at my job and my wife takes care of the children. If I lived like most people around me I would hardly have any money left at the end of the month.

If you have time to watch Netflix or Youtube, you have time to make money. It is that simple.

Of course, a person needs to relax as well.

My investments are reaching a point where I should start to make them tax efficient. I haven’t worried about it since I am not a huge income earner and taxes have never been a problem.

This now means that I will focus more of my REIT investing into my IRA while buying more growth-type companies in my taxable brokerage.

These trades happened between April and May. I fully funded my 2016 IRA, got my tax return and then put that money into fully funding my 2017 Roth.

That means I put in $11,000 into these investments! Holy cow!

Read on to find out what I bought, I am sure at least one of them will surprise you.

Medical Properties Trust (MPW) –

As the name implies, MPW is a healthcare REIT. They own 247 facilities located in 30 states and 5 countries. 66% of their portfolio are General Hospitals, 24% are Rehabilitation Hospitals, and the remaining 10% are long-term care hospitals and medical office buildings. MPW is the landlord that owns the buildings and leases them on long-term contracts to different operators who run the place.

This allows a relatively predictable cash flow that allows them to pay a decent dividend. Still, their tenants might run into financial troubles and that happened with a tenant company called Adeptus Health, which provided 7% of MPW’s revenue.

Also, due to the possibility of governmental change of Obamacare and/or Medicare the market has given many healthcare REITs the cold shoulder. Between the problems with Adeptus Health and the general cautious behavior the market is giving the healthcare sector, the stock dropped. I decided to buy.

It has also helped that they sold some underperforming assets last year. That enabled them to pay down debt and jump on some higher yielding properties. Their payout ratio dropped from 83% to 71% so they now have more room to increase the dividend in the years to come.

I firmly believe that healthcare services will always have a market regardless of government intervention, so my purchase of 120 shares @ $13.72. This will add $115.20 to my yearly dividends. That’s a yield of over 7%.

New Senior Investment Group (SNR) –

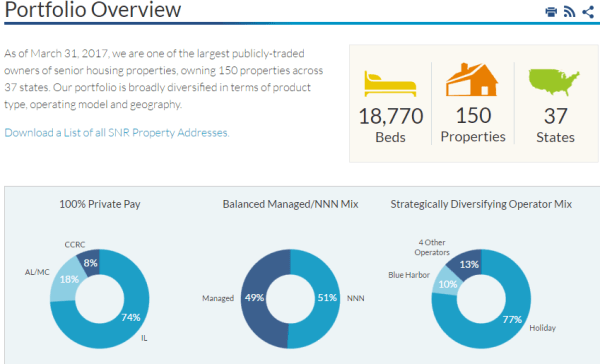

New Senior is a smaller healthcare REIT that owns mostly independent-living (65%) senior housing properties. Instead of their revenue coming from government sources such as Medicaid, SNR is 100% private pay. This shields them from sensitivity to healthcare law reform.

But SNR is still risky.

It has a lot of debt and several underperforming assets. This has caused them to sell or consider selling assets, as any profits from the sale can be used to decrease debt.

Another risk is that SNR’s properties as mostly leased to just two operators, Holiday runs 77% and Blue Harbor runs 11%. If one of these companies ran into troubles, it would dramatically effect SNR.

It also has a very slim coverage margin of its dividend. In the last quarter, AFFO (adjusted funds from operations) was 27 cents/share while the dividend is 26 cents/share.

Due to these problems, SNR is trading at the lowest valuation compared to its peers.

I feel that senior living facilities is an area with plenty of long-term tailwinds as there is estimated to be twice the amount of people over the age of 65 by the year 2050. If management can pilot the company past the current problems, there will be great reward for shareholders.

It is also possible another healthcare REIT will buy up SNR to obtain all the assets they own.

In the meantime SNR is paying a dividend over 10%. So I snatched up 100 shares @ $10.36, adding $104 to my annual dividend income.

OMEGA HEALTHCARE INVESTORS (OHI) –

Like SNR, Omega is a REIT focused on owning properties that house the elderly. Instead of independent living, OHI has more skilled nursing and assisted living facilities.

Their AFFO shows that OHI has plenty of dividend coverage, and has increased the dividend by at least a penny every quarter since 2011.

The debt level show no signs of them being over-leveraged. OHI is also decently diversified, the biggest tenant accounts for just 10% of revenue.

Seems that the price is being kept low because of fears of a cut to Medicaid payments. A cut would hurt OHI as most people in its facilities can only afford care due to government payments.

Would the government really send the old folks out of care homes? That seems like election suicide to me.

I owned OHI in my taxable account but have been wanting to bring it into the tax shelter that is an IRA, the Roth IRA is a very good tax shelter for REITs. So I purchased 100 shares @ $31.62 with plans to sell the 86 I have in my taxable brokerage and buy more growth oriented stocks with the proceeds.

Air Lease Corp (AL) –

This company purchases and then leases (or sells) aircraft to airlines. Aircraft leasing has grown and more airlines are seeing the benefit of using the services of companies such as AL.

Aircraft take a long time to be received after placing an order with the manufacturer. If an airline leases they can have more aircraft flying their routes much quicker.

Looking at the financial numbers it shows a company priced at a good value and showing great revenue growth.

They have also recently started paying a dividend and, while it is still low at just .8%, they have been increasing it at a fast rate. The increase from last year was 50%!

I picked up 38 shares @ $36.60 adding a small $11.40 to my annual dividend total.

Facebook (FB) –

Facebook has shown itself to be a money printing machine! Revenues have gone from 12.47 billion in 2014 to 27.64 billion in 2016, while income has increased from 2.94 billion to 10.21 billion in that same time frame.

That is just amazing growth.

They also own Instagram and WhatsApp, which translates to billions of daily users.

All of which FB has an incredible amount of data about. This allows targeted ads directed towards individuals that have shown interest in similar products. Advertisers have realized how powerful that is, and as more and more pay to have their advertisements shown it will lead to FB being able to charge higher rates for that screen space.

FB’s cash horde will allow them to purchase any up and coming company they want to acquire, or create their own version of it. They have shown it is no big deal for them to copy any features that Snapchat might come up with and deploy it on FB or Instagram.

FB is quickly becoming as powerful as Google.

I bought 10 shares @ $142.04 and will look to acquire more.

Celanese Corporation (CE) –

Celanese is in the basic materials and technology industry. They manufacture the ingredients that can be found in everything from paints and coatings to electronics to food and medical items.

I don’t think the need for their products is going to disappear. It is also not a small company as it has a $13 billion dollar market cap and has production facilities in 30 countries.

I found out about this company by searching through David Fish’s dividend list.

What attracted me to it was its great dividend growth rate. Its 10-year average increase was 24%, while its 5-year is an outstanding 41.9%! Celanese’s last dividend increase went from 36 to 46 cents, a 27.78% increase. Management has also stated they are planning on giving large increases over at least the next three years.

It currently yields about 2.1% with a low payout ratio of just over 25%. Plenty of room for dividend growth.

After more research I liked what I saw. A solid company in a sector I have minimal exposure to. I think I will own this one for quite some time.

This was the last purchase I made and was able to pick up 14 shares @ $87.30. It will boost my yearly dividends by $25.76.

BTL Group LTD (OTC: BTLLF) –

I am pretty sure you have never heard of this Canadian company before, but it might interest you if you are interested in cryptocurrencies at all. They are developing a blockchain technology called Interbit to provide financial and asset trading services.

Ethereum-based Interbit platform enables institutions to issue and transfer assets over a network using smart contracts and Blockchain technology to automate processes and reduce costs. It has been in beta status while working on major pilot projects with financial giants like Visa, huge European banks, and multi-billion dollar energy companies.

This could bridge the distance between cryptocurrencies and those that don’t believe in them.

This stock has risen along with cryptocurrencies, going from 90 cents to $4.85 YTD.

It is also a huge gamble as Interbit might fail and not come into common use.

But I can take a chance, so I picked up 300 shares @ $3.52. It has been doing well so far, currently it is up to $4.85.

If this stock explodes upward, I plan to sell 100 shares at around $10 to recoup my initial investment and let the 200 shares ride. The blockchain has so much potential but is very volatile.

Conclusion

This is two years’ worth of Roth IRA contributions totaling $11,000. At the current dividend rates, I will be paid the following amounts annually.

Air Lease: $11.40

Celanese: $25.76

New Senior: $104

Medical Properties Trust: $115.20

Omega Healthcare Investors: $252

Total Annual Dividends: $508.36 or a yield on total investment of 4.62%

This rate includes the approximately $2,500 invested in non-dividend paying stocks (FB, BTTLF).

These shares are part of the Scottrade ‘FRIP’, or flexible re-investment plan. All dividends go into a holding area and are used to purchase stocks on a set date without commissions.

(If you are interested in opening an account with Scottrade, use my referral code: KAEB9040 and we will both get three free trades)

Currently, all dividends are being directed to purchase OHI each quarter. This should allow me to increase my holdings of OHI by 3 or 4 shares every three months. Of course, the purchase could be redirected to buy any other company I already own in my rIRA. If one share price gets hit hard, I might adjust to capture the bargain.

My plan is to add to my IRA each year, rarely sell any stocks, and allow tax-free compounding to work.

18 comments

Skip to comment form ↓

Mrs. Picky Pincher

June 6, 2017 at 5:47 am (UTC -7) Link to this comment

Thanks for outlining your new investments! I’m currently investing in a 401k only, since I’m paying off debt right now. But once we knock out the student loans, we plan to overhaul our investments significantly. 🙂

Mrs. Picky Pincher recently posted…I Am More Than My Pokemon Cards

MrDD

June 6, 2017 at 4:14 pm (UTC -7) Link to this comment

Hey, most debt comes before investing! I totally understand. You are knocking your debt out so fast that when you switch over to investing it is just going to go up so fast!

DivHut

June 7, 2017 at 9:29 pm (UTC -7) Link to this comment

Holy cow indeed! That’s a huge sum of money you put to work. I’m impressed to see such aggressive buying when some of our fellow investors are selling some or all of their portfolios in anticipation of a correction. I like the health REITs of all the REITs that exist long term. I also looked at AL at one time but did not buy. For now, I am focused on strict dividend growth stocks but clearly you are branching out to other names that do not pay dividends or are very speculative. Nothing wrong with going that route as long as these investments meet your tolerance for risk.

DivHut recently posted…Dividend Income Update May 2017

MrDD

June 8, 2017 at 3:49 pm (UTC -7) Link to this comment

Ha yea, sometimes I wish the next crash would just happen already so everyone could stop worrying about it. 😛

I know BTL Group is speculative, but it is a risk I can take. As for AL, I know the dividend is low right now at .8% – but it has been growing dividends at an average rate of 32%. It also has a low payout ratio of just 8.6%. If dividends were tripled to 2.4% then the payout ratio would still be a low 25.8%. Heck, it could pay a 4.8% dividend and be at a 50% ratio. But they use most of their money for growth, which is good for the long term. So I decided to become an owner.

Thanks for stopping by DivHut, love reading your growth.

Mr Defined Sight

June 9, 2017 at 12:52 pm (UTC -7) Link to this comment

Nice job, love those dividend yields! Speaking of which, today was payday from XOM. Love seeing those roll in. June is a pretty heavy dividend payout month for me so I’m going to wait until the end of the month to do some buying. I don’t currently have the FRIP engaged but I have thought about it.

Mr Defined Sight recently posted…Ditch Your Job Like A Bad Relationship

MrDD

June 9, 2017 at 4:23 pm (UTC -7) Link to this comment

Hey, I have no problems with people that want to just save up the dividends and re-invest them in a company of their choosing. The thing is to re-invest those dividends because the difference between re-investing and not is exponential years down the road.

Gotta love the heavy dividend months of 3-6-9-12! XOM is a good one, pretty solid even with the troubles that oil has been in these past few years.

B

June 9, 2017 at 10:39 pm (UTC -7) Link to this comment

Hitting Reits into the IRA makes sense because you dont hv to pay taxes there if you dont sell them and just reap the dividends in.

Did you purposely hit the Reits to increase your portfolio yield by any chance?

B recently posted…“Jun 17″ – SG Transactions & Portfolio Update”

MrDD

June 10, 2017 at 8:54 am (UTC -7) Link to this comment

I have been watching REITs for awhile now, especially the healthcare ones. Now that I am actually having tens of thousands invested in something other than index funds in my TSP I thought I better start working towards better tax efficiency. Though, I have been falling into the lower tax brackets where dividends are taxed at 0%, I am not too far off from having to pay taxes on them.

Since I had been eyeing up the REITs and wanting to increase tax efficiency I bought them in my Roth IRA, which is the best place for them. It will be a great way to just let them re-invest for years. By the time I use them for income I should see the double whammy of more shares and increased dividend amounts. That’s the plan anyway.

Ashley

June 10, 2017 at 6:26 am (UTC -7) Link to this comment

Hey Justin,

I’m sorry for contacting you like this but couldn’t find an email on the site.

I love your site and was wondering if you wanted to discuss a possible sale? If so, email me at mrmoneybanks@multimillionaireroad.com.

Best wishes

Ashley

timeinthemarket

June 11, 2017 at 2:44 pm (UTC -7) Link to this comment

That’s a pretty sweet boost to your annual income bud! You’re totally right on the side hustle front although sometimes I’m a bit too lazy after work to get mine going :)!

MrDD

June 11, 2017 at 5:43 pm (UTC -7) Link to this comment

Jeez, you and me both. This work thing has got to go! 😀

FIbythecommonguy

June 12, 2017 at 6:05 pm (UTC -7) Link to this comment

That is a nice chuck of change to invest and $500 in annual dividends is great. Keep it up and you will be amazed at how quickly it will grow.

FIbythecommonguy recently posted…A move is coming

MrDD

June 12, 2017 at 10:56 pm (UTC -7) Link to this comment

That it is, $11,000 is more than my yearly mortgage! I already calculated that the dividends should buy me about 15 shares of OHI this year.

FIbythecommonguy

June 13, 2017 at 4:03 am (UTC -7) Link to this comment

15 shares is great. I have all my dividend investments set to auto buy additional shares with each dividend paid. I have owned OHI for ~ 2 years and have bought 21 shares from dividends. Get ready to start receiving those dividends!

FIbythecommonguy recently posted…A move is coming

Meow

June 15, 2017 at 7:11 pm (UTC -7) Link to this comment

Wow, those are some great healthcare REIT ideas!! I currently own HCN, CCP and LTC. I’m pretty stoked about the whole sector so I’m going to look into yours. OHI, SNR and MPW. I agree that an IRA is a great place to house these because of the tax shelter.

As for FB, I think it’s over hyped and over valued. 42.62 p/e? Then again, I don’t mess with any of the glamorous tech stocks. I like a boring, stable dividend.

Meow recently posted…Compound Interest: The Most Important Money Idea

MrDD

June 15, 2017 at 8:40 pm (UTC -7) Link to this comment

If I had to rank the three best to worse I would say OHI is the best, followed by MPW and SNR. I agree, the sector is on a great sale. The fears that the government is going to stop paying for the elderly to live in carehomes is ridiculous. To me at least. The government is going to throw the old people out on the street? No way.

More and more baby boomers are retiring, and sometime in the future they might need to move to a skilled nursing facility or an independent living situation. Both places are covered by these REITS.

I look at the growth rates of FB, and their high margin profits from online advertising and I see no cause to be alarmed by the high trailing PE. Google is alright to me as well. I stay away from Amazon, Netflix, or Tesla.

Tim Kim @ Tub of Cash

July 10, 2017 at 2:07 pm (UTC -7) Link to this comment

“If you have time to watch Netflix or Youtube, you have time to make money. It is that simple.”

Shots fired! Lol. I completely agree with you here though. I think people have more free time than they think. And yes I agree that one needs downtime to wind down, but a lot of times it’s a bit excessive. And when they do wind down, it’s usually the whole getting sucked into hours of youtube where at the end of the day, you don’t even feel too great. You actually end up feeling more guilty afterwards knowing how much of a waste of time that was!

MrDD

July 10, 2017 at 8:27 pm (UTC -7) Link to this comment

Haha, yeah I guess I just saw too much complaining about being broke – all on sites that are there to waste time, like imgur.

I agree that no one can be all go all the time and will need time to unwind. If you don’t like your current situation in life though, you have to be motivated enough to not get stuck in it and use that time to work towards improving your life.